HST Credit

Get Consultation

+91 75584-270-20

+91 75584-270-20

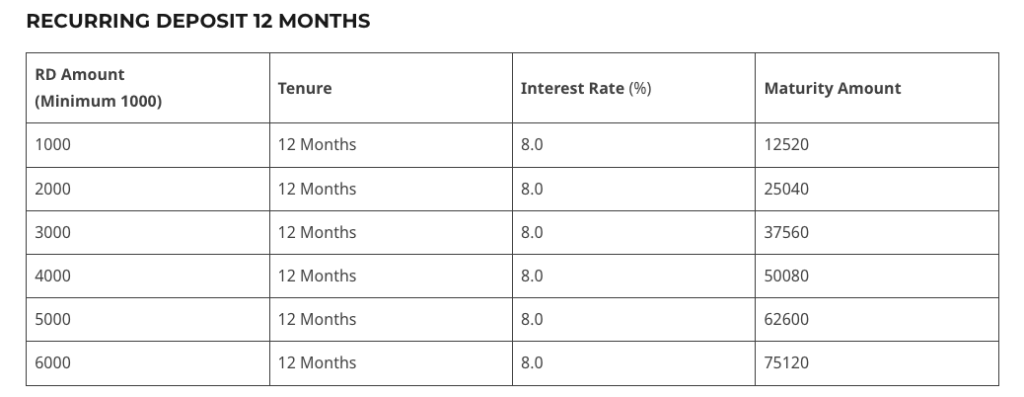

हैदर सैलानी ताज अर्बन क्रेडिट कोऑपरेटिव सोसाइटी की आवर्ती जमा योजना नियमित रूप से एक निश्चित राशि हर माह जमा कर बचत की आदत को प्रोत्साहित करती है। यह योजना उन लोगों के लिए आदर्श है जो समय के साथ वित्तीय लक्ष्यों को प्राप्त करना चाहते हैं और विश्वसनीय रिटर्न प्राप्त करना चाहते हैं। ₹500 के न्यूनतम जमा के साथ एक आरडी खाता खोलें और भविष्य की योजनाओं के लिए सुरक्षित और सुविधाजनक बचत का लाभ उठाएं।

The minimum tenure for an RD account is 12 months or more, allowing you to save on a long-term basis.

Payments to the company can be made by cash, cheque, or draft. Members must ensure all payments are made against a company-issued receipt signed by an authorized signatory. Any payment methods not mentioned are at the member’s own risk. Cheques or drafts are credited once cleared, and outstation cheques are not accepted.

Every RD account holder receives a passbook to track transactions. Members should update their passbooks regularly. In case of discrepancies between the passbook and official receipts, payment will only be made based on receipts duly signed by the branch’s authorized signatory.

Great service! The loan process was quick and hassle-free. Highly recommend them for any financial needs.

Need more details or have questions? We’re here to help clarify and provide the information you need. Contact us now!

+91 75584-270-20

Design By i9 Digital Marketing © 2023 ALL RIGHTS RESERVED

Please Share the details to get a call back from us.